Does Minimalism Save Money?

As many of you discovering this site will know, Minimalism, at its core, is a lifestyle choice that emphasises intentional living and the reduction of material possessions. We choose to adopt this lifestyle here at Barefoot Intention as the philosophy encourages us to prioritise based on our needs and values over the societal pressures to accumulate more. By focusing on what truly adds value to one’s life, minimalism seeks to eliminate excess and create a more meaningful and fulfilling existence. If we are focusing our attention in this way, many ask can practicing minimalism save money?

If you’re new to minimalism check out beginner’s guide.

How Can Minimalism Save Money?

The principles of minimalism are therefore deeply intertwined with financial well-being. One of the most significant aspects is the conscious effort to reduce spending on what are non-essential items. This approach not only helps in decluttering one’s physical environment but also results in considerable financial savings. When we choose to purchase only what we genuinely need or what enhances our lives, we can naturally cut down on unnecessary expenses and therefore practicing Minimalism saves money.

Moreover, minimalism is not about depriving yourself of comforts or pleasures. Instead, it is about making deliberate choices that align with your priorities and long-term goals. For instance, rather than accumulating a closet full of clothes that rarely get worn, a minimalist may invest in a few higher quality pieces that they truly love and use regularly. This shift in mindset can lead to more thoughtful and purposeful spending habits, ultimately contributing to better financial health.

Adopting the minimalist lifestyle often leads to a greater appreciation for experiences over unnecessary material goods. This can result in reallocating funds towards activities that bring joy and enrichment, such as travel, education, or hobbies, rather than the latest fashion trends. Consequently, minimalism fosters a more sustainable and financially responsible way of living, where the focus is on quality over quantity.

You’ll see that minimalism and financial well-being are closely linked. By embracing the principles of intentional living and reducing unnecessary material possessions, you can achieve significant savings and create a more fulfilling and financially stable life.

How Can Minimalism Reduce Daily Expenses?

Adopting a minimalist lifestyle can significantly reduce daily expenses by encouraging more intentional spending and a focus on quality over quantity. This approach can lead to a series of financial benefits that mean practicing minimalism save money through the accumulation of a more cost-effective way of living.

Reducing and Removing Impulse Purchases

One of the primary ways minimalism reduces daily expenses is by curbing impulse purchases. As Minimalists we are more deliberate about our buying decisions, often reasonably questioning the necessity of an item before making a purchase. That doesn’t mean we deprive ourselves, we simply make better buying decision through removing the impulse. This level of mindfulness can lead to substantial savings over time, as it eliminates some unnecessary expenditures.

Eating In versus Eating Out

Another area where minimalism can cut costs is in dining habits. Minimalists often prefer cooking at home to eating out, which can be considerably less expensive. Preparing meals at home not only saves money but also allows for healthier and more controlled food choices, contributing to overall well-being.

Quality over Quantity

In addition to these practices, minimalism encourages us to make the selection of quality over quantity. By investing in fewer, but higher-quality items, minimalists reduce the need for frequent replacements. For instance, instead of buying multiple pairs of low-cost shoes that wear out quickly, a minimalist might opt for one durable, well-made pair that lasts much longer. This principle applies to various aspects of life, from clothing to household goods.

Financial Advantages

To summarise the financial advantages, here are some key points on how minimalism reduces daily expenses:

- Reduced Impulse Purchases: Mindful buying decisions help avoid unnecessary spending.

- Less Dining Out: Cooking at home is more economical and healthier.

- Quality over Quantity: Investing in durable items reduces the need for frequent replacements.

By incorporating these practices, we experience significant savings, making minimalism not only a lifestyle choice but also a financially prudent one.

Can Minimalism Help in Cutting Down Monthly Bills?

Ability to Downsize

Adopting a minimalist lifestyle can significantly contribute to reducing monthly bills in various ways. When we acquire mindfully we avoid clutter and can enjoy the potential savings is downsizing living space. By opting for a smaller home or apartment, we can all potentially reduce our rent or mortgage payments, which let’s face it, make up a substantial portion of monthly expenses. A smaller living space not only lowers housing costs but also typically reduces property or council taxes and maintenance fees.

Reduce Ineffective Costs

Another effective strategy can be minimising subscriptions and unused memberships. When we are not living intentionally, we can accumulate multiple subscriptions and memberships over time, such as streaming services, gym memberships, and duplicate subscriptions. By evaluating which of these are truly necessary and eliminating the unused or superfluous ones, we can save a considerable amount each month. This conscious and approach encourages spending only on what adds true value to one’s life.

Reduce Utility Costs

We want to be intentional in all aspects of our lives and so minimalism can promote mindful energy use, leading to lower utility bills. Owning fewer electronics and appliances means less electricity is consumed, and being intentional about energy usage—such as turning off lights when not in use and using energy-efficient devices—further contributes to savings. Simple habits like these can make a noticeable difference in monthly utility costs.

Potential Savings

Below is a list of potential monthly savings that can be achieved through minimalism:

- Housing Costs: Downsizing can save £200 to £500 or more per month.

- Subscriptions/Memberships: Cutting unnecessary services can save £50 to £100 per month. They really do quickly mount up!

- Utility Bills: Mindful energy use can reduce costs by £30 to £60 per month.

By embracing minimalism, we not only simplify our lives but can also enjoy the financial benefits of reduced monthly bills. This approach encourages a more intentional and sustainable way of living, ultimately leading to greater financial freedom and peace of mind.

How Does Minimalism Impact Debt Reduction?

Minimalism can be a transformative approach to managing and reducing debt. By prioritising our needs over wants, we can allocate more financial resources towards debt repayment. This shift in lifestyle emphasises the importance of thoughtful spending, encouraging us to question the necessity of each purchase. Instead of indulging in non-essential items, the minimalist mindset fosters a disciplined approach to finances, ensuring that money is directed towards paying off debts more effectively.

What about You?

You may be reading this as a young professional, overwhelmed by credit card debt. Feeling the strain of financial pressure. What can minimalism do for you? If you decided to adopt a minimalist lifestyle, starting by decluttering your living space, selling unnecessary items, and using the proceeds to pay off a portion of your debt. What if you then created a strict budget, focusing solely on essential expenses. By cutting down on dining out, unnecessary subscriptions, and impulsive shopping, you could funnel a significant portion of your income towards debt repayment. Imagine that feeling when you’ve successfully eliminated that credit card debt and the profound sense of financial freedom you’d like be feeling.

Perhaps you have faced substantial student loan debt. Embracing minimalism, you might choose to downsize your living arrangements, moving into a smaller, more affordable flat or apartment. What if you adopted a minimalist wardrobe, reducing your clothing expenses dramatically. By simplifying your lifestyle and focusing on what truly mattered, you could pay off those student loans ahead of schedule. The psychological benefits of financial freedom would likely be immense with reduced stress and anxiety as a result of achieving a debt-free status.

So, Minimalism not only aids in debt reduction but also offers significant psychological benefits. The financial freedom that can be achieved through a minimalist lifestyle can lead to improved mental well-being. Without the constant worry of debt, we can enjoy a greater sense of security and peace of mind. This newfound stability allows for more meaningful and fulfilling life experiences, reinforcing the value of a simplified lifestyle.

What Are the Long-Term Financial Benefits of Minimalism?

Adopting a minimalist lifestyle can have profound long-term financial benefits, offering not only immediate savings but also paving the way for a more stable and secure financial future. Minimalism encourages individuals to prioritise our spending, focusing on what truly adds value to our lives while eliminating unnecessary expenses. This shift in perspective can result in significant financial advantages over time.

You Can Save More Money

Firstly, Minimalism often leads to increased savings. By cutting back on non-essential purchases, we can allocate more funds to our savings accounts. This accumulation of savings can serve as a financial cushion, providing security in times of emergency or uncertainty. Moreover, with fewer financial obligations, there is more room to contribute to retirement accounts, which is crucial for long-term financial stability.

Have the Ability to Invest

Secondly, minimalism can free up resources for investments. With additional disposable income, we can take advantage of investment opportunities that can yield substantial returns over time. Whether it’s stocks, bonds, or real estate, having more capital available for investment can significantly enhance one’s financial portfolio.

Reduce your Debt

Thirdly, a minimalist lifestyle can reduce debt. By avoiding unnecessary purchases and focusing on paying off existing debts, individuals can diminish their financial liabilities. Less debt means less interest, leading to significant savings over the long term. After such historically low interest rates, the rise of recent interprets rates post pandemic has hit many of us hard. Also, this reduction in debt can also improve credit scores, opening doors to better financial opportunities in the future.

Meaningful Experiences

Lastly, minimalism can lead to spending on more meaningful experiences rather than material possessions. Investing in experiences such as travel, education, or personal development can enrich one’s life and provide lasting satisfaction. These meaningful expenditures often bring more joy and fulfilment than the temporary pleasure of acquiring material goods.

In summary, the long-term financial benefits of minimalism are multifaceted:

- Increased savings and financial security

- More funds available for investments

- Reduction of debt and associated interest payments

- Spending on meaningful experiences rather than material items

By embracing a minimalist lifestyle, we can achieve a more stable and less stressful financial future, allowing us to focus on what truly matters in life.

Are There Costs to Minimalism?

Professional Organiser Services

While minimalism is often promoted as a lifestyle that leads to financial savings, there can be some initial costs for those that need more support. At the outset, the journey towards a minimalist lifestyle may entail some initial expenses. For instance, some choose to hire a professional organiser to help declutter your living space can be a considerable investment. This cost might be justified by the efficiency and expertise that such professionals can bring. If you feel this can be of help to you, then remember to add that to your budget.

Buying Higher Quality

Additionally, as minimalists we encourage each other to invest in higher-quality items that last longer, rather than frequently replacing cheaper, lower-quality goods. While this strategy can lead to long-term savings, the upfront cost of purchasing durable, high-quality products can be significant. When starting out on your minimalist journey, remember that this is a way of life and that we can start slowly and go at our own pace. Mindfully purchasing well made and high quality goods at a time that is right for our own circumstances, can avoid the significant outlay that some over enthusiastic beginner minimalists can experience.

Impacts of Being Too Frugal

There is a school of thought in minimalism regarding frugal living. This can lead to the potential for some to become overly frugal. While the minimalist ethos encourages cutting back on unnecessary expenditures, it is crucial to stay mindful and avoid taking this to an extreme. We do not advocate for the removal of life’s essential comforts and conveniences in the name of this practice. That can lead to a diminished quality of life, for instance, skimping on medical care, healthy food, or other vital services can result in higher costs down the line, both financially and in terms of personal well-being. If you live in a country where medical care is outside of the state, please do treat this as one of your essential costs!

In summary, while the minimalist lifestyle offers numerous financial benefits, it is essential keep a firm focus on intentional living and be realistic with your own personal circumstances. By carefully considering both the costs and benefits, we can make informed decisions that support a simplified yet financially savvy lifestyle.

How Can One Start Embracing Minimalism to Save Money?

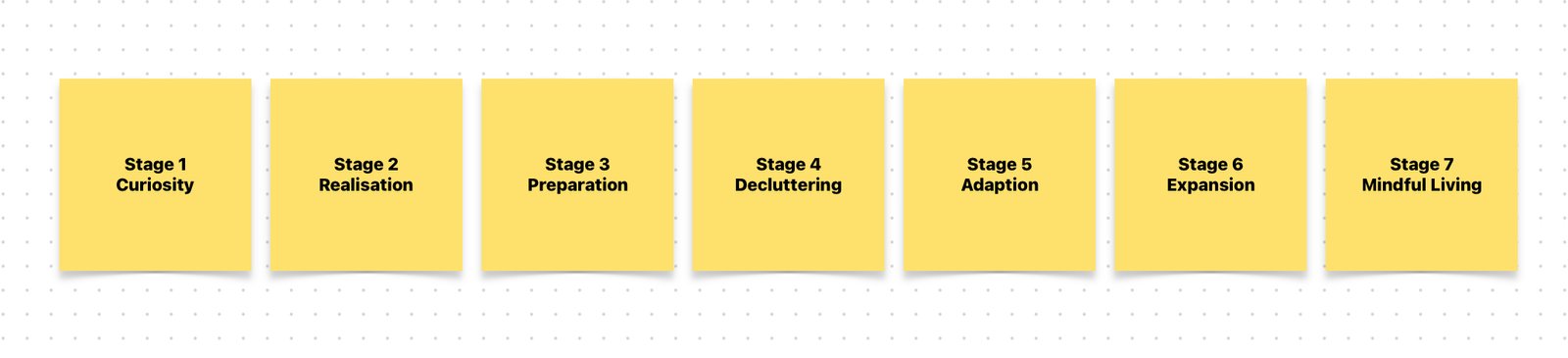

Embarking on a minimalist lifestyle to save money requires a structured approach and a conscious shift in habits. The journey towards minimalism can be both rewarding and financially beneficial, but it starts with clear, actionable steps. For those that landed here first, here is a practical guide to help you begin:

1. Declutter One Room at a Time:

Begin by focusing on a single room. Remove items that no longer serve a purpose or bring joy. This process not only helps in creating a more organised space but also enables you to sell or donate unwanted items, potentially generating extra income or tax deductions.

2. Create a Budget:

Establishing a budget is crucial. Track your monthly income and expenses to identify areas where you can cut back. Prioritise essential spending and allocate funds towards savings and debt repayment. Tools like budgeting apps can simplify this process.

3. Prioritise Spending:

Focus on purchasing items that add value to your life. Avoid impulse buying by making a list before shopping and sticking to it. Consider adopting a “one in, one out” policy where you only buy something new if you get rid of something you already own.

4. Seek Support:

Surround yourself with resources and communities that encourage minimalist principles. Books like “Goodbye Things” by Fumio Sasaki or “The Life-Changing Magic of Tidying Up” by Marie Kondo can offer insights and motivation. Online forums and social media groups can provide a sense of community and shared purpose.

5. Step-by-Step Checklist:

- Identify your why – Understand the reasons behind your choice to adopt minimalism.

- Start small – Begin with an easy area to build momentum.

- Set clear goals – Define what minimalism means to you and set realistic targets.

- Declutter regularly – Make decluttering a consistent habit rather than a one-time event.

- Reflect and adjust – Periodically review your progress and make necessary adjustments.

By following these steps and utilizing available resources, you can effectively embrace minimalism and enjoy the financial benefits of a simplified lifestyle.

What Are the Pros and Cons of Minimalism for Financial Health?

Minimalism, as a lifestyle choice, offers various advantages and disadvantages, particularly in the context of financial health. Understanding these pros and cons can help individuals make informed decisions about adopting a minimalist lifestyle.

Pros of Minimalism for Financial Health

Reduced Stress

By owning fewer possessions and eliminating unnecessary expenses, minimalism can lead to a significant reduction in financial stress. The focus shifts from material accumulation to meaningful experiences, promoting a sense of financial well-being.

Save Money

Minimalism encourages mindful spending and prioritises needs over wants. As a result, individuals often find themselves saving more money, which can be redirected towards investments, emergency funds, or other financial goals.

Less Debt

Adopting a minimalist approach often involves paying off existing debts and avoiding new ones. The reduced desire for material goods can lead to fewer instances of credit card usage and other forms of borrowing, ultimately leading to a more debt-free lifestyle.

What are the Cons of Minimalism for Financial Health

Initial Costs

Transitioning to a minimalist lifestyle may involve some upfront costs for some people. For instance, investing in high-quality, durable items that replace multiple cheaper ones can be expensive initially. However, these costs are often offset by long-term savings. As we’ve said above, this can be mitigated by maying intentional and mindful decisions about your own circumstances and by living this lifestyle at your own pace.

Challenge of Changing Habits

Shifting to minimalism requires a significant change in mindset and habits. This can be challenging for individuals accustomed to consumer-driven lifestyles. The process of decluttering and simplifying can be time-consuming and emotionally taxing, potentially deterring some from fully committing to minimalism. As we say on this site, start small and build momentum!

Conclusion

Ultimately, the decision to adopt minimalism should be based on individual circumstances and priorities. We believe the financial benefits of reduced stress, the ability to save money, less debt are all compelling. This could be the lifestyle you are looking for if you are mindful not to get caught up in a flurry of over enthusiastic initial costs chasing this new lifestyle aesthetic and have patience with yourself while adapting to the challenges of changing habits. Start living intentionally, question your why and your values. Minimalism might be just what you need to start saving money now!